ADA Price Prediction: Technical Setup and Positive News Flow Suggest Potential Rally to $1

#ADA

- Positive MACD momentum suggests strengthening bullish trend potential

- Resolved audit concerns remove significant regulatory overhang from ADA

- Technical setup supports potential move toward $0.9556 resistance level

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Despite Short-Term Pressure

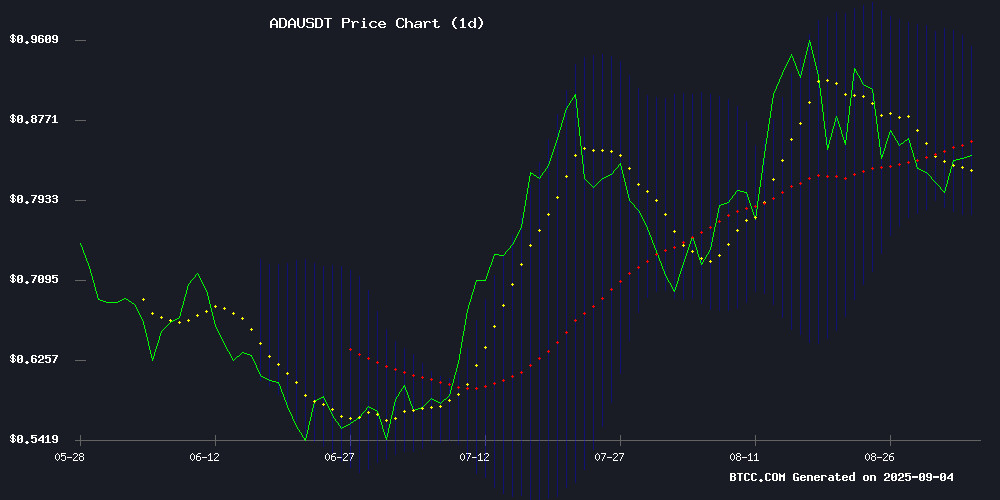

According to BTCC financial analyst Emma, ADA's current price of $0.81 sits below its 20-day moving average of $0.8647, indicating some short-term bearish pressure. However, the MACD reading of 0.0317 above the signal line suggests building bullish momentum. The Bollinger Bands show ADA trading closer to the lower band at $0.7738, which could present a potential buying opportunity if support holds. Emma notes that a break above the middle Bollinger Band at $0.8647 could signal a MOVE toward the upper band resistance at $0.9556.

Positive News Sentiment Supports ADA Recovery Outlook

BTCC financial analyst Emma highlights that recent news FLOW has turned decidedly positive for Cardano. The resolution of the $600M ADA voucher audit, which cleared founder Charles Hoskinson and confirmed 99.7% redemption rates, has removed a significant overhang. Combined with the 5% price surge defying broader bearish sentiment, these developments suggest improving market confidence. Emma believes the cleared audit hurdles could support ADA's potential rally toward the $1 psychological level.

Factors Influencing ADA's Price

Cardano Founder Calls for 'No Confidence' Vote Amid $600M ADA Scandal

Charles Hoskinson, founder of Cardano, has demanded a vote of no confidence in the Cardano Foundation following allegations of mismanagement involving 300 million ADA tokens, valued at over $600 million. The controversy stems from accusations that Hoskinson used a "genesis key" to seize unclaimed funds from a 2015 pre-sale—a claim he vehemently denies.

A third-party forensic audit commissioned by Hoskinson found no evidence to support the allegations. The audit revealed that most ADA vouchers were redeemed, with remaining funds transferred to a secure custodial account and later to Intersect, a decentralized governance body. "The integrity of Cardano is at stake," Hoskinson stated, suggesting potential legal action against the foundation.

Charles Hoskinson Fires Back as Audit Confirms 99.7% ADA Redemption

Cardano's redemption controversy has been resolved after an independent audit confirmed 99.7% of ADA vouchers were properly redeemed. The findings clear founder Charles Hoskinson and the network of misuse allegations.

Hoskinson responded sharply on social media, demanding apologies from critics who accused insiders of diverting tokens and manipulating hard forks. The allegations had raised concerns among retail holders about the integrity of Cardano's early distribution.

The audit revealed 97.3% of vouchers were redeemed during Cardano's Byron era, increasing to 99.2% by mid-2025. Unclaimed tokens were transferred to Cardano Development Holdings and now fund ecosystem grants through governance body Intersect.

Cardano Founder Cleared in $600M ADA Voucher Audit, Demands Apology from Critics

Cardano founder Charles Hoskinson has been exonerated by a 128-page forensic audit investigating allegations of misappropriating $600 million in unredeemed ADA vouchers. The report, conducted by BDO and McDermott Will & Emery, confirms over 99% redemption rates and finds no evidence of blockchain manipulation during the 2021 Allegra upgrade.

The voucher system—an unconventional fundraising mechanism where early investors purchased redeemable certificates rather than direct ADA tokens—had drawn scrutiny years after mainnet launch. Critics alleged hidden code in Cardano's hard fork allowed improper use of unclaimed assets, prompting IOG to commission the independent review last May.

Hoskinson now demands retractions from detractors, marking a vindication for one of crypto's most methodically developed projects. The findings reinforce Cardano's reputation for regulatory compliance amid growing institutional interest in proof-of-stake networks.

Cardano Clears Audit Hurdle as ADA Eyes $1 Rally

Cardano's ADA token shows bullish technical formation after an independent audit dispelled voucher redemption concerns. The cryptocurrency now trades at $0.84, positioned above key moving averages with a clear path toward testing the $0.95 resistance level.

Forensic auditors confirmed 99.7% of ADA vouchers were properly redeemed, removing a lingering overhang on investor sentiment. Technical indicators suggest growing momentum, with the 50-day SMA providing support at $0.83 and Bollinger Bands indicating room for expansion toward upper resistance levels.

The MACD histogram's approach to a bullish crossover coincides with neutral RSI readings at 50.15, creating conditions for a potential 25% upside move. Market technicians identify $1.05 as a viable target should ADA breach the $0.95 Bollinger Band resistance within the next 4-6 weeks.

Cardano Defies Bearish Sentiment with 5% Price Surge

Cardano's ADA token has climbed 5% despite retail traders turning bearish, marking the lowest sentiment levels in five months. Market analysts observe a classic accumulation pattern—whales and long-term holders are stepping in as frustrated retail participants exit.

The divergence between price action and crowd psychology suggests underlying strength. Historically, such sentiment extremes often precede rallies when institutional money quietly builds positions against prevailing retail narratives.

Is ADA a good investment?

Based on current technical indicators and recent positive developments, ADA presents an interesting investment opportunity. The MACD showing bullish momentum combined with resolved regulatory concerns creates a favorable setup. However, investors should monitor key resistance levels and consider dollar-cost averaging given cryptocurrency volatility.

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $0.81 | Below 20-day MA, potential value |

| 20-day Moving Average | $0.8647 | Key resistance level to watch |

| MACD | 0.0317 | Bullish momentum building |

| Bollinger Upper Band | $0.9556 | Near-term upside target |

| Bollinger Lower Band | $0.7738 | Support level |